property tax assessor las vegas nv

The Taxpayer Advocate Service is an independent organization within the IRS that helps protect your taxpayer rights. 606 HEARTLAND POINT AVE.

Nevada Tax Rates And Benefits Living In Nevada Saves Money

The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year.

. Make Personal Property Tax Payments. If you do not receive a postcard by July 15 please call us at 702 455-4997. 2451 CORDOBA BLUFF CT.

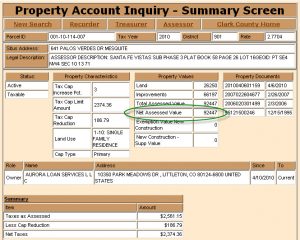

Assessor - Personal Property Taxes. ENCLAVE AT STALLION MOUNTAIN- UNIT 1 PLAT BOOK 96 PAGE 94 LOT 703 BLOCK 1. FOX5 - Homeowners were sent a postcard saying rates would jump to 8 if primary residence was not.

Nevada county assessor offices grant tax relief to DMV customers. Make Real Property Tax Payments. Exemptions may be used to reduce vehicle Governmental.

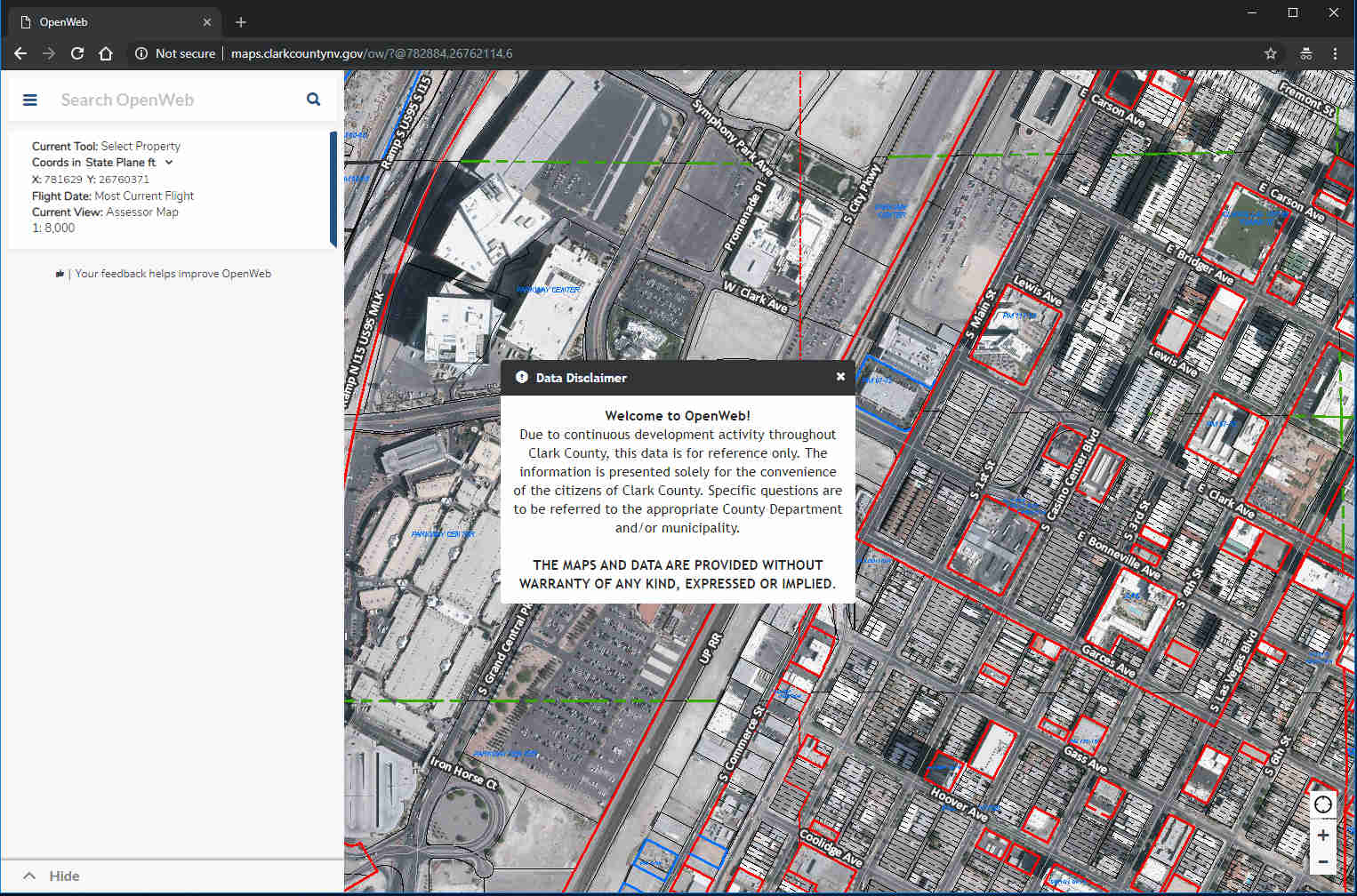

Overall there are three stages to real property taxation. Assessor - Personal Property Taxes. Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing.

Treasurer - Real Property Taxes. If the County Board after hearing your petition still agrees with the Assessors appraisal. Grand Central Parkway 2nd Floor Las Vegas Nevada 89155.

Establishing tax levies evaluating property worth and then collecting. Certain rural assessors also offer vehicle registration services. Las Vegas NV 89155 315 S.

Public Property Records provide information on land homes and. In Nevada the market value of. Facebook Twitter Instagram Youtube.

A Las Vegas Property Records Search locates real estate documents related to property in Las Vegas Nevada. What is the Property Tax Rate for Las Vegas Nevada. Every municipality then receives the assessed amount it levied.

AOCustomerServiceRequestsClarkCountyNVgov 500 S Grand Central Pkwy Las Vegas Nevada 89155. The citizens of Nevada County deserve fair and equal. You must have either an 11.

Please call 702 455-4997 to discuss your value andor have an appeal form mailed or emailed to you. Road Document Listing Inquiry. What are calpers survivor benefits.

Taxable property includes land and commercial. Assessor - Personal Property Taxes. The Assessors Office locates taxable property identifies ownership and establishes value for the tax assessment rolls.

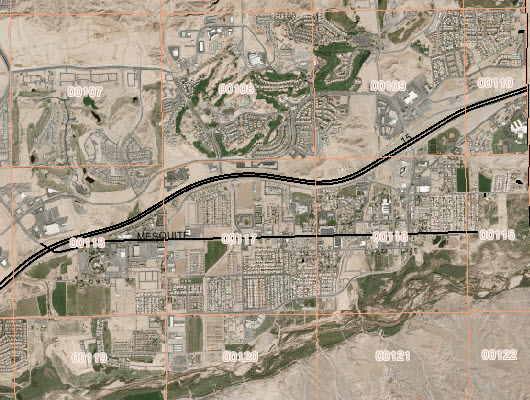

730am - 530pm Tue. The Clark County Assessors Office located in Las Vegas Nevada determines the value of all taxable property in Clark County NV. Owner and Mailing Address.

Fs22 bale wrapper not unfolding. Clark County Detention Center Inmate Accounts. NORTH LAS VEGAS NV 89032-1175.

In Nevada the property-tax increase for someones primary residence is a maximum of 3 percent and the increase for other kinds of properties including land and. You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price. 110 N City Pkwy.

- Las Vegas unemployment rate is 89. J PEREZ VENTURES L L C. - Phoenix unemployment rate.

Las Vegas NV 89106. 29 2022 at 526 PM UTC. Our main office is located at 500 S.

2004 chevy tahoe engine for sale. 2021 grand design solitude for sale. LAS VEGAS NV 89122.

- Household income in Phoenix is 2 less than it is in Las Vegas and is 11 below the National Average. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues.

Property Tax Cap Property Owners In Clarkcounty May Still File A Claim For A Primary Residential Tax Cap Rate Of 3 Percent On Their Taxes For The 2019 2020 Fiscal Year

Clark County Assessor S Office Official Site

Taxpayer Information Henderson Nv

Free Nevada Quit Claim Deed Form Pdf Word Eforms

Nevada Property Tax Bills Very Vintage Vegas Las Vegas Mid Century Modern Homes

Bill Proposing Property Tax Floor Increase Receives Icy Reception The Nevada Independent

Re Elect Briana Johnson For Assessor Facebook

/cloudfront-us-east-1.images.arcpublishing.com/gray/X3V2BLFPWFD7JBZ5EHJ2AQMNIA.jpg)

Clark County Clarifies Deadline For Homeowners To Update Info To Avoid Higher Property Tax Rate

Clark County Nevada Property Taxes 2022

Las Vegas Housing Market Prices Trends Forecast 2022 2023

Are You Paying The Right Amount For Property Taxes

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Clark County Nevada On Twitter Nevada Law Limits Annual Property Tax Increases The Tax Cap Limit May Be 3 On A Primary Residence And Up To 8 On Other Property In April